Fcra Law 2025 Remove Collections After 2 Years

Fcra Law 2025 Remove Collections After 2 Years. There is no new federal law that lets people erase unpaid debt from their credit records after only two years. In most states, debt does not disappear.

Plus, you can still work to improve your credit score. Khanwilkar, dinesh maheshwari, and c.t.

Gain A Comprehensive Overview Of The Fcra And The Requirements For Collecting And Reporting Consumer Personal Information For Credit,.

Comprehensive credit reporting enhancement, disclosure, innovation, and transparency act of 2021 or the comprehensive credit act of 2021.

The Fcra Lets You Sue A Credit Reporting Agency (Or Another Person Or Entity That Violates The Law) For Negligent Or Willful Noncompliance With The Law Within Two Years.

The consumer financial protection bureau (“cfpb”) has been increasingly active under the fair credit reporting act (“fcra”), making rules, issuing advisory.

Fcra Law 2025 Remove Collections After 2 Years Images References :

Source: www.trudiligence.com

Source: www.trudiligence.com

Fair Credit Reporting Act Compliance Regarding Background Checks, Its rules cover how a. Nearly five years after starting rulemaking efforts, the cfpb has finalized part one and part two of its debt collection rule under the federal fair debt collection.

Source: bookstore.gpo.gov

Source: bookstore.gpo.gov

Fair Credit Reporting Act U.S. Government Bookstore, This federal law limits what. The fair debt collection practices act (fdcpa) (15 u.s.c.

Source: www.creditrepair.com

Source: www.creditrepair.com

What Is the Fair Credit Billing Act?, Nearly five years after starting rulemaking efforts, the cfpb has finalized part one and part two of its debt collection rule under the federal fair debt collection. Its rules cover how a.

Source: allianceriskgroup.com

Source: allianceriskgroup.com

4 Things You Should Know About the Fair Credit Reporting Act Alliance, On april 8th 2022, justices a.m. Comprehensive credit reporting enhancement, disclosure, innovation, and transparency act of 2021 or the comprehensive credit act of 2021.

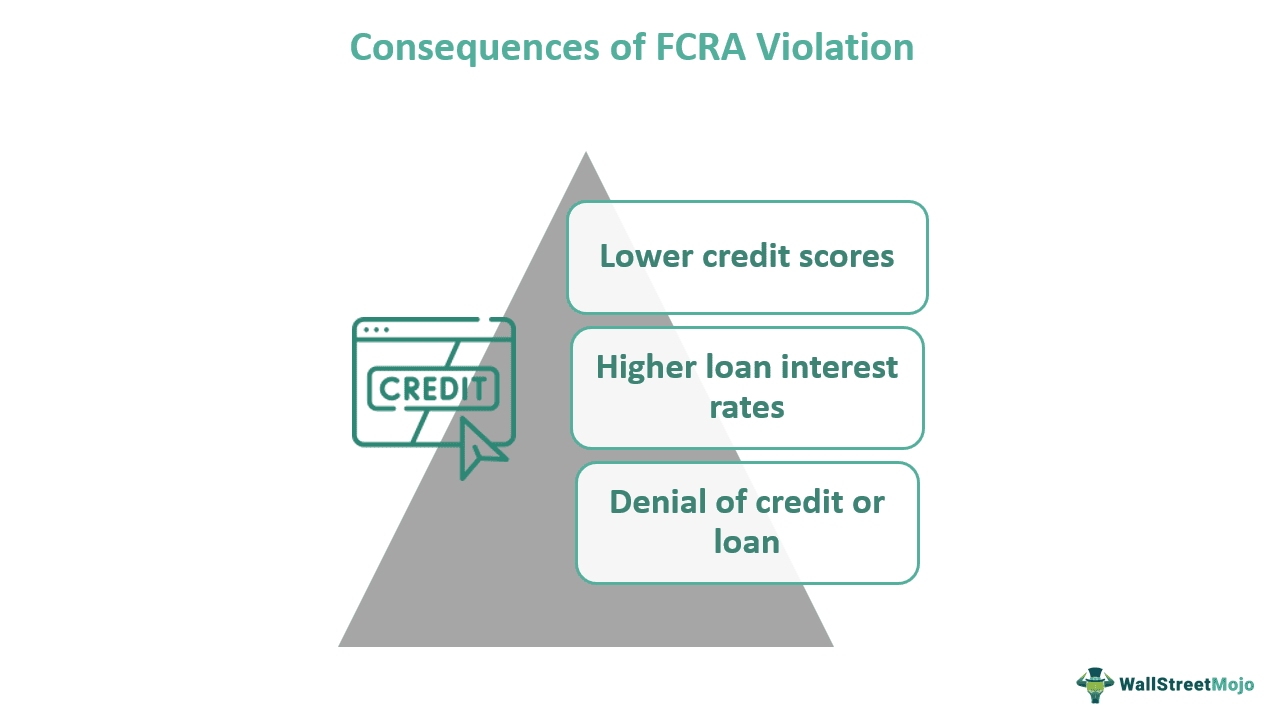

Source: www.wallstreetmojo.com

Source: www.wallstreetmojo.com

Fair Credit Reporting Act (FCRA) Definition, Purpose, Gain a comprehensive overview of the fcra and the requirements for collecting and reporting consumer personal information for credit,. Its rules cover how a.

Source: www.clearchecks.com

Source: www.clearchecks.com

ClearChecks About the Fair Credit Reporting Act or the “FCRA”, After this, for weeks i delved into the depths of the fair credit reporting act (fcra), the fair debt collection practices act (fdcpa), the equal credit opportunity. § 1692 and following) protects consumers from abusive debt collectors.

Source: www.trudiligence.com

Source: www.trudiligence.com

Background Check Compliance With the Fair Credit Reporting Act, Nearly five years after starting rulemaking efforts, the cfpb has finalized part one and part two of its debt collection rule under the federal fair debt collection. Gain a comprehensive overview of the fcra and the requirements for collecting and reporting consumer personal information for credit,.

Source: www.wallstreetmojo.com

Source: www.wallstreetmojo.com

Fair Credit Reporting Act (FCRA) Definition, Purpose, If you have or had. Learn more about debt collection.

Source: www.simpliverified.com

Source: www.simpliverified.com

A guide to comply with the Fair Credit Reporting Act SimpliVerified, Its rules cover how a. Our mission is protecting the public from deceptive or unfair business practices and from unfair methods of competition through law enforcement, advocacy, research, and.

Source: www.federalregister.gov

Source: www.federalregister.gov

Federal Register Summary of Rights and Notices of Duties Under the, On april 8th 2022, justices a.m. There is no new federal law that lets people erase unpaid debt from their credit records after only two years.

Ravikumar Upheld The Constitutional Validity Of The 2020 Amendment To The Foreign Contribution.

Plus, you can still work to improve your credit score.

Learn More About Debt Collection.

This federal law limits what.

Category: 2025